Investing Beyond The Metropolitans

- Jul 10, 2023

- 2 min read

Updated: Jul 18, 2025

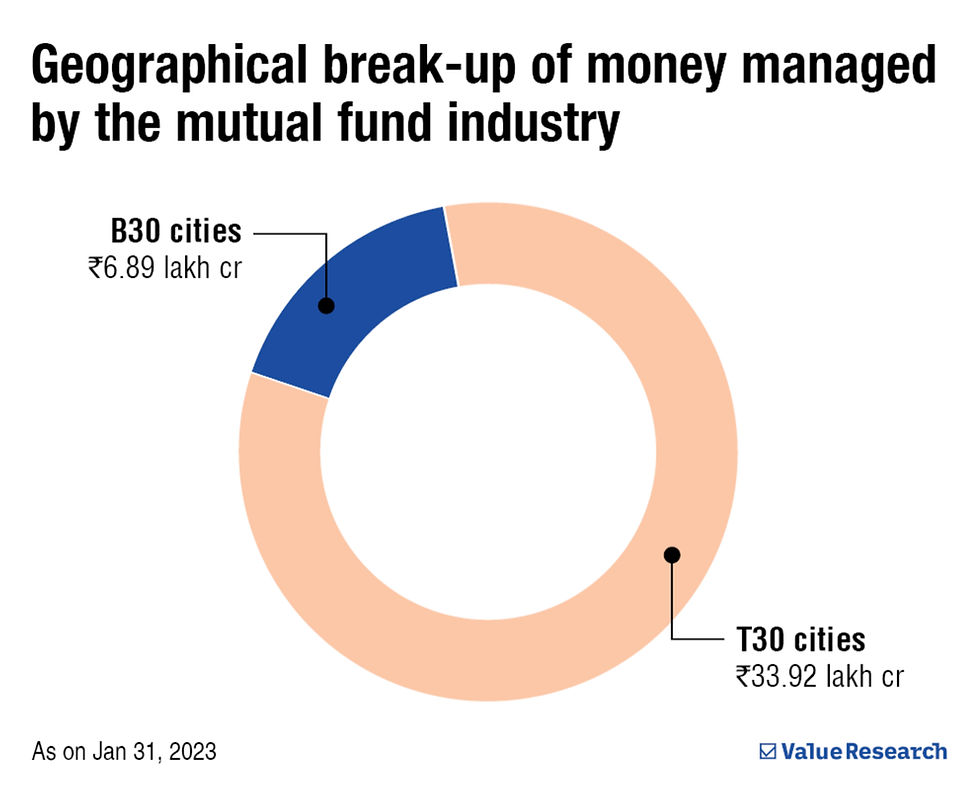

Mutual fund investments are slowly gaining traction in India’s smaller cities, with B30 cities now contributing 17% to the sector’s total assets. SEBI’s efforts to enhance investor awareness and access through local collaborations and tech-driven platforms have made mutual funds more accessible. With the rise of new products and educational programs, are smaller cities becoming the next big investment hub?

The Securities and Exchange Board of India (SEBI) has categorised Indian cities into Top 30 (T30) and Beyond 30 (B30), where T30 consists of major metropolitan areas with established markets, and B30 includes other cities with limited financial presence, including smaller and midsized cities.

Traditionally, expansion of mutual fund houses in B30 cities has been challenging due to limited awareness, distribution channels, infrastructure, lower income levels, investment capacity, and the lingering effects of the pandemic. The low popularity of mutual funds in small cities and towns has generally been attributed to factors like the preference for guaranteed return investments (e.g., fixed deposits, post office schemes), which have been considered safer than mutual funds.

However, B30 cities’ contribution to the mutual fund industry’s assets has steadily increased, contributing nearly 16% of the total assets of Rs 27.26 lakh crore.

In February 2023, the contribution had reached 17%, amounting to Rs 6.9 trillion. SEBI’s significant role in promoting engagement between mutual fund houses and B30 cities has led to more branches and offices in these cities, directly serving investors.

To promote investor awareness, seminars and programmes are conducted, while collaboration with local banks and financial institutions is expanding the investor base. Customised schemes and products catering to the specific needs of investors are also being innovated upon, and technological advancements such as online platforms and mobile apps have enhanced mutual fund accessibility.

Have you invested in Mutual Funds?

Yes

No

Comments